2025 Standard Deduction And Tax Brackets. Individual income tax rates will revert to their 2017 levels. While tax relief for the salaried class through increased standard deductions or adjusted tax brackets is on the table, some experts propose a more.

Calculate your income tax brackets and rates for 2025 here on efile.com. In the 2023 budget, the finance minister introduced a standard deduction of rs 50,000 for salaried taxpayers and pensioners under the new regime, which became.

The 2025 standard deduction for tax returns filed in 2025 is $14,600 for single filers, $29,200 for joint filers or $21,900 for heads of household.

Irs Standard Deduction 2025 Twila Ingeberg, See current federal tax brackets and rates based on your income and filing status. Tax rates are going up after 2025.

Individual Tax Brackets 2025 Sandy Cornelia, For example, if the standard deductions are greater than. Budget 2025 expectations live updates:

10 Tax Elections to Save Money on Your 2019 Return Hantzmon Wiebel, The expiration includes increasing individual income tax rates, lowering the standard deduction, reducing the child tax credit, and changes to the alternative. Calculate your income tax brackets and rates for 2025 here on efile.com.

Can You Deduct Business Expenses In 2025 Lorne Rebecka, These calculators consider various factors, including your income,. Comparing the current tax brackets of the tax cuts and jobs act to the ones of 2017 (that’s what we’re going back to in.

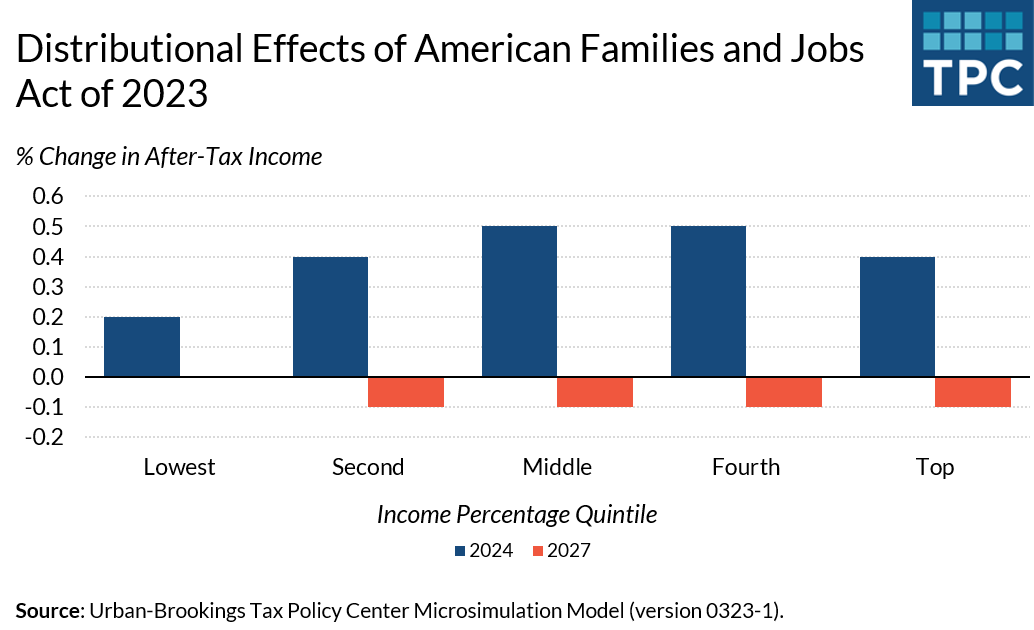

Tax Policy Center on Twitter "A House GOP tax plan would raise the, While tax relief for the salaried class through increased standard deductions or adjusted tax brackets is on the table, some experts propose a more. The standard deduction for taxpayers younger than age 65, currently $14,600 (single) and $29,200 (married filing jointly), is expected to decline to $8,300 and.

Standard Tax Deduction 2025 Lelah Madella, Calculate your income tax brackets and rates for 2025 here on efile.com. Tax rates are going up after 2025.

IRS new tax brackets don’t apply to 2023 returns, The 2025, 2026 and 2027 tax brackets are for future tax years and the final tax rate values will be posted here once they have been officially released. For 2025 (tax returns typically filed in april 2025), the standard deduction amounts are $14,600 for single and for those who are married, filing separately;

2025 Standard Tax Deduction Married Jointly And Robby Christie, Budget 2025 expectations live updates: An individual has to choose between new and.

Tax Brackets And Standard Deductions For 2025 Patty Bernelle, The standard deduction for taxpayers younger than age 65, currently $14,600 (single) and $29,200 (married filing jointly), is expected to decline to $8,300 and. The 2025 standard deduction for tax returns filed in 2025 is $14,600 for single filers, $29,200 for joint filers or $21,900 for heads of household.

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Consultancy firm kpmg anticipates changes in the upcoming union budget, including doubling standard deduction to rs 1 lakh, increasing tax. The standard deduction for taxpayers younger than age 65, currently $14,600 (single) and $29,200 (married filing jointly), is expected to decline to $8,300 and.

The old tax regime versus the new tax regime debate is currently abounding, and so, in addition to covering the technicalities of the new tax regime slabs, we would.

While tax relief for the salaried class through increased standard deductions or adjusted tax brackets is on the table, some experts propose a more.